Get a VAT refund on everything you buy during your trip to France with ZappTax!

Remember to get your VAT refund on everything you buy during your trip to France! With ZappTax, it’s never been easier.

Everyone loves a bargain, and this is a bargain that lasts all year, whether you’re shopping for yourself, your children, or for a gift.

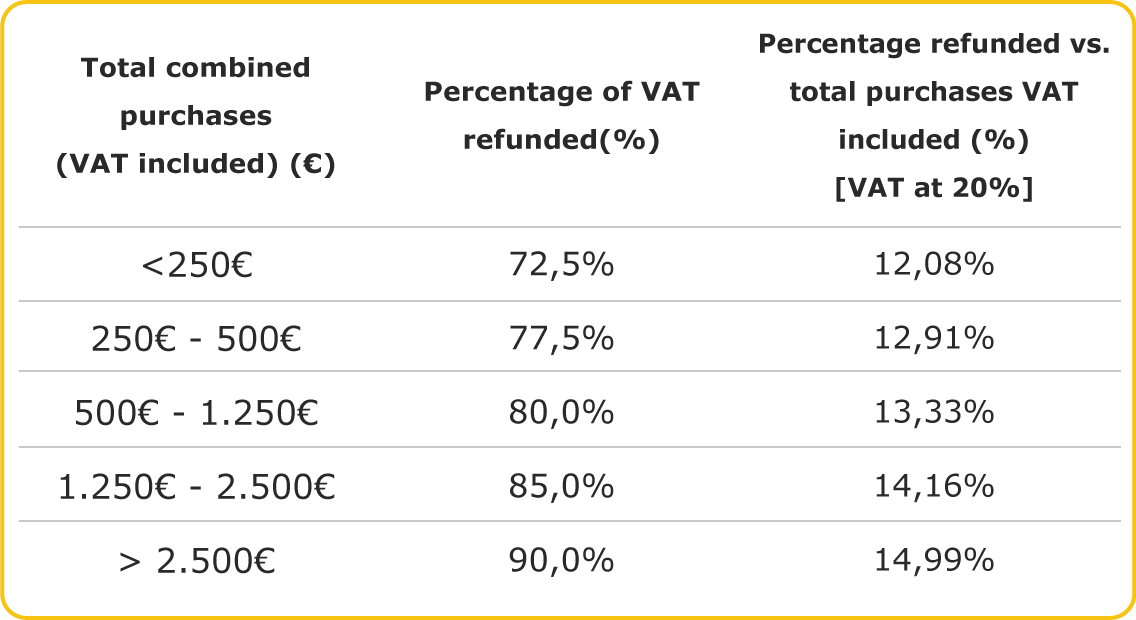

So when you visit France, remember to request a VAT reimbursement on your souvenirs. It could save you an average of 14% on all your purchases, so why hesitate? Let us tell you how it’s done.

How do you qualify for a VAT refund?

- You must reside outside the European Union.

Since Brexit, all UK residents are eligible for a VAT refund. A British subject residing in the UK can get a VAT refund on any purchases made in France. If, on the other hand, you reside in France, you are not eligible.

- You must leave the EU with all the items for which you are requesting a VAT refund.

To qualify for the tax refund, you must leave the EU with your purchases in your luggage. This is also true for any online purchases delivered to you in France.

- You must leave the EU before the end of the third month following the month of your purchases.

How does ZappTax help you get your refund?

It couldn’t be easier, whether you made your purchases in store or online (note that online purchases must be delivered to an address in France, Spain, or Belgium, and that you must bring them back with you in your personal luggage).

- Easy to use – When shopping, ask at the time of payment for a “VAT invoice made out to ZappTax”. Then take photos of your invoices and upload them to the ZappTax app.

- For all your purchases – Once all your purchases have been completed, request your tax-refund form. It will then be sent to you in digital version by email (and also available in the app).

- Easy validation – Validate your form when leaving the European Union (in France and Spain, directly from your smartphone at a self-service terminal; in Belgium, by presenting your passport to a customs officer).

- Quick refunds – Once your documents have been validated, you will receive your VAT refund within 24 hours according to the refund method of your choice.

How much could I save?

The ZappTax application is available on the App Store and on Google Play

Share to: Facebook Twitter LinkedIn Email

More in Sponsored Content